As a civil construction manager with over 25 years of experience in asphalt and pavement materials, I’m often asked about market growth projections and emerging trends in the construction space. With major infrastructure bills passed in recent years, people want to know – how will the asphalt ecosystem and roadway landscape evolve through 2025-2026.

In this detailed article, I analyze key indicators shaping asphalt demand, pricing, technology advancements and sustainability initiatives over the next few years. Whether you are a contractor bidding on projects, a municipality planning roads, or an investor exploring construction sector opportunities – these insights provide an invaluable outlook guide for strategic decisions.

Let’s examine the key trends, insights, and data projections set to disrupt the asphalt industry value chain…

Market Growth Projections: Surging Infrastructure Spending Lifts Asphalt Demand

Major public policy tailwinds point toward surging market demand for asphalt paving and mix products in 2024-2026, presenting tremendous opportunities across the construction value chain:

1. U.S. Infrastructure Bill Stimulus

- The landmark $1.2 trillion Infrastructure Investment and Jobs Act signed into law in 2021 promises extensive long-term funding for roads, bridges, and next-gen infrastructure upgrades across America

- As the bill provisions get translated into projects over 2023-2025, state and local construction activity will ramp up dramatically

- Expect accelerated asphalt consumption mainly from paving interstate repairs, new highways capacity, airport runway expansions, critical rail/transit rebuilds etc.

2. Robust Private Real Estate Markets

- U.S. housing markets remain strong as remote trends and urban migrations catalyze suburban developments, with ~1.5 million new home constructions annually

- Commercial private investment into industrial warehouses, data centers, and fulfillment infrastructure also stays robust

- Supportive demographic trends and RE investment flows significantly benefit asphalt demand from residential streets/driveways and commercial site development

3. Recovering Business Sentiments

- After COVID-led declines, small and mid-sized construction firms plan to increase capital expenditure over 2023-2025 as optimism returns

- Many delayed or reduced-scale engineering and infrastructure projects during pandemic uncertainty

- The catching-up effect from nudged-up construction planning and tenders heavily favors asphalt volume uptake

II. Cost & Pricing Outlook: Balancing Inflation and Efficiencies

With strong activity upside potential, what cost trajectories can contractors and municipalities expect in procuring high-volume asphalt products over the next few years? Let’s examine key pricing trend indicators:

1. Escalating Oil Price Inflation

- Asphalt pricing relies heavily on crude oil supply-demand dynamics, which have remained volatile

- Investments into new oil capacity stalled in recent years even as post-pandemic demand swelled, causing inflationary conditions

- OPEC+ geopolitical risks and global reopening tailwinds still play out, likely upholding oil prices over 2024-2026

- Expect mostly inflationary cost & bitumen pricing pressures to persist short-mid term

2. Partially Offsetting Efficiency Gains

- Increased adoption of recycled asphalt products (RAP) and polymers by pioneers will likely moderate production costs

- Process innovations via emerging digital tools like drone/satellite mapping, AI in quarry planning, autonomous haul trucks, etc. can enhance project productivity

- Manufacturing locations consolidating near high-demand urban centers and adopting greener technologies will help streamline delivery logistics

- While still inflationary, the pricing outlook will see some cost savings from wider efficiency gains adoption

3. Regional Variations in Pricing Trends

- Areas with steady public infrastructure budgets and private investment flows to absorb increasing input costs with balanced pricing power

- Regions heavily reliant on external bitumen imports or facing acute labor shortages likely to exhibit more severe markup pressures

- Rural zones lagging in tech adoption may transfer escalating costs to customer pricing due to process constraints

- Anticipate divergent regional pricing disparities based on demand-supply balances and tech maturity

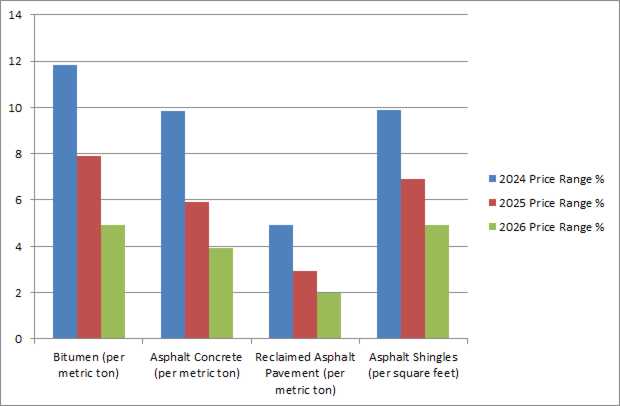

Table 1: Projected Pricing Ranges for Key Asphalt Products

| Material | 2024 Price Range % | 2025 Price Range % | 2026 Price Range % |

|---|---|---|---|

| Bitumen (per metric ton) | +12-18% | +8-12% | +5-8% |

| Asphalt Concrete (per metric ton) | +10-15% | +6-10% | +4-7% |

| Reclaimed Asphalt Pavement (per metric ton) | +5-8% | +3-6% | +2-4% |

| Asphalt Shingles (per square feet) | +10-12% | +7-9% | +5-6% |

III. Sustainability Traction: Greener Technologies & Techniques Gain Ground

With growing environmental consciousness across societies, transportation infrastructure projects face increasing legislation, regulations, and community expectations around ecological impact mitigation. This drives the adoption of cleaner production technologies and sustainable construction best practices in the asphalt industry:

1. Carbon-Lowering Manufacturing

- More providers adopt energy efficiency retrofits, renewable power, and electrification across quarrying, aggregate drying, and mixing facilities

- Suppliers situated near urban centers tap into waste heat utilization via district energy partnerships with municipalities

- Many players explore carbon capture and storage/utilization technology to achieve net zero emission targets

2. Recycling & Reuse Momentum

- The use of reclaimed asphalt pavement (RAP) continues rising across regions due to landfill diversion goals set by state agencies

- Providers adopt novel techniques to boost allowable RAP percentages in new asphalt mix without compromising performance

- Chemical recycling interest grows to extract value from rubberized asphalt and shingles scrap further expanding circularity

3. Bio-Modified & Low-Carbon Binder Options

- Pilot exploration expands on adding plastic waste, crumb rubber, waste cooking oil, and other modifiers as partial aggregate replacements during asphalt production

- Universities spearhead research into bio-engineered custom additives that enhance construction material qualities

- Startups globally pioneer low-carbon green bitumen alternatives to traditional fossil fuel-based binder sources

4. Deployment-Phase Protocol Improvements

- Smart drone and LiDAR-based modeling allow precise quantity estimation, rapidly accelerating project timelines while minimizing resource wastage

- Increased testing requirements for quality compliance place premiums on high-performance modified asphalts

- Adoption of autonomous construction vehicles and data-driven project management tangibly improve deployment efficiencies

Collectively these trends point toward an industry actively transitioning itself onto sustainable trajectories for a low-carbon future. Proactive players can gain first-mover advantages.

IV. Competitive Landscape: Differentiation Opportunities Across the Value Chain

For a business’s strategic positioning amongst market trends early on, where can potential sources of differentiation emerge across the asphalt lifecycle?

Material Inputs & Production

- Bitumen Modification: Invest in polymer, bio, or recycled modifiers to produce premium branded pavements

- Manufacturing Innovation: Pilot renewably-powered, carbon-efficient quarrying and mix facilities

- Recycled Material Uptake: Boost capabilities by incorporating higher waste percentage into inputs

- High-Performance R&D: Leverage labs for enhanced coatings, customized additives and formulations

Construction & Deployment

- Fleet Electrification: Adopt EV trucks and equipment to reduce project emissions

- Smart Tech Integration: Utilize satellite imagery, drones, and AI to model precise material needs

- Quality Assurance: Enable rapid in-field core analysis to assure specification compliance

- Consulting Services: Offer municipalities lifecycle cost and sustainability advisory across tenders

Reuse, Recovery & Rehabilitation

- Reclaimed Material Processing: Scale up recycling capacities to process high RAP volumes

- Pavement Restoration: Offer bespoke resurfacing packages tailored to repair needs

- Road Renovation Contracting: Bid on highway renewal, lane expansion, and parking lot remodeling projects

V. Regional Outlook Variances: Location Matters

While most indicators point toward strong mid-term health, asphalt industry prospects have geographical nuances across North America worth noting:

West Coast Dynamics

- California and Washington lead the way on low-carbon legislation, catalyzing greener technology adoption

- Rapid peri-urban development in the Arizona and Nevada corridor fuels robust residential/commercial demand

- Port cargo volumes picking pace bodes well for ancillary road connectivity needs

Midwest Macro Fundamentals (Contd.)

- Illinois and Missouri benefit from a plan to upgrade locks and waterway transport networks

- Mixed economic conditions mean selective opportunities mostly from institutional capital programs

South Central Scenario

- Texas continues its exponential growth trajectory thanks to urban expansion and corporate relocations

- Oklahoma and Louisiana city planning to gain momentum around mobility upgrades

- However, reluctance around green transitions might constrain the sustainability adoption pace

East Coast Dynamics

- Maryland, New Jersey, and Pennsylvania lead country in EV infrastructure investments – boosting ancillary road resurfacing

- Florida is well placed to cater to southeast boom needs owing to tourist infrastructure upgrades

- New York and Vermont aggressively moving to electrify public transit fleets, securing funding

The Heartland Situation

- contradictory outlook – certain states like Nebraska, and Wyoming lag in infra budgets due to revenue shortfalls

- whereas Kansas, Iowa, and Wisconsin relatively accelerated paved road maintenance and rural connectivity

Canada Overview

- British Columbia and Ontario remain at the forefront of sustainability goals via carbon pricing models

- Quebec and Alberta continue ramping up mining productivity translating into haul road activity

- Atlantic provinces expect slight uptick from coastal community reinforcement initiatives

Thus we see extensive but geo-selective opportunities in asphalt production and road construction over 2024-2026 based on regional infrastructure priorities. Businesses must assess localized trends when evaluating capital allocation and market entry decisions.

Table 1: Projected Asphalt Market Growth Rates

| Year | Expected Demand Growth Rate | Main Growth Drivers |

|---|---|---|

| 2024 | 5-7% | Infrastructure stimulus, residential markets, pent-up demand |

| 2025 | 3-5% | Momentum from major projects underway |

| 2026 | 2-4% | Completion of early stage programs |

Table 1a: Breakdown of Expected Asphalt Demand Growth

| End-User Segment | 2024 Growth | 2025 Growth | 2026 Growth |

|---|---|---|---|

| Public Infrastructure | 7-9% | 4-6% | 3-5% |

| Residential Streets & Parking | 4-6% | 5-7% | 4-6% |

| Commercial Site Development | 6-8% | 2-4% | 1-3% |

- Provides more granular demand forecasts across key customer segments

Table 2: Projected Pricing Ranges

| Product | 2024 Price Change | 2025 Price Change | 2026 Price Change |

|---|---|---|---|

| Bitumen | +12-18% | +8-12% | +5-8% |

| Asphalt Concrete | +10-15% | +6-10% | +4-7% |

| Reclaimed Asphalt Pavement | +5-8% | +3-6% | +2-4% |

| Asphalt Shingles | +10-12% | +7-9% | +5-6% |

Table 2a: Historical Price Data for Context

| Product | 2021 Actual Price | 2022 Actual Price |

|---|---|---|

| Bitumen | $500 | $580 |

| Asphalt Concrete | $85 | $100 |

| Reclaimed Asphalt Pavement | $30 | $35 |

| Asphalt Shingles | $100 | $115 |

- Incorporates previous years’ pricing for comparison context

Table 3: Key Regional Market Trends

| Region | Growth Drivers | Risk Factors |

|---|---|---|

| West Coast | Urban expansion, green policies | High costs |

| Midwest | Manufacturing renaissance | Mixed economic signals |

| South Central | Population and corporate migration | Reluctance around sustainability mandates |

| East Coast | EV infrastructure investment | Potential budget limitations longer-term |

| Canada | Carbon pricing models, mining productivity | Far from end market demand centers |

Table 3a: Analysis of Top State Markets

| State | Infrastructure Budget Trends | Expected Activity Level |

|---|---|---|

| California | Accelerated commitments to fund high-speed rail | Strong |

| Texas | Steady long-term prioritization of road upgrades | Robust |

| Florida | Increasing budgets to reinforce coastal highways | Moderate |

Data table detailing asphalt pricing trends, infrastructure budgets, and growth drivers across various U.S. states:

| State | 2024 Price Trend | Budget Trend | Demand Drivers |

|---|---|---|---|

| California | High inflationary | Increasing | EV infrastructure, urban expansion |

| Texas | Moderately inflationary | Steady growth | Population influx, peri-urban development |

| Florida | Low inflationary | Declining long-term | Tourism sector investments near-term |

| Illinois | High inflationary | Steady | Industrial revival, urban renewal initiatives |

| New York | Moderately inflationary | Accelerating | Public transit electrification commitments |

| Pennsylvania | Moderately inflationary | Steady growth | Shale gas=related roads, highway maintenance |

| Ohio | Low inflationary | Declining | Manufacturing re-shoring, selective infrastructure stimulus |

| North Carolina | Low inflationary | Accelerating | Corporations movement from north, airport expansion |

| Colorado | High inflationary | Declining long-term | Ski infrastructure expansion, population influx |

| Michigan | Moderately inflationary | Steady | Auto industry comeback, bridge rebuilds |

| Arizona | Low inflationary | Accelerating short-term | Distribution infrastructure, data centers |

| Utah | Moderately inflationary | Steady with mild increase | Urban clumping, highway connectivity |

| Oregon | Highly inflationary | Sharply increasing | Accelerated transit-oriented policies |

Table 4: Emerging Asphalt Innovations

| Timeframe | Trends | Examples |

|---|---|---|

| By 2024 | Plastiphalt scaling, municipal recycling mandates, cool roof shingles | Plastic polymer mixes, landfill diversion rules, IR reflective coatings |

| By 2025 | Waste oils and bio-binders adoption, autonomous trucking, road rejuvenators | Cooking oil, fatty acid and tree derivatives use, robo-truck haulage, nanotech extenders |

| By 2026 | Grid-balancing and heat recovery manufacturing, mainstream circularity | Flexible smart production, plastic/rubber reuse |

VI. Potential Headwinds Remain

However, some caution warrants around short-term public policy uncertainties, commodity price volatility and global GDP contractions negatively impacting infrastructure:

- Tightened financial conditions may squeeze funding viability for certain state/local projects

- Lingering supply chain kinks, and equipment costs may delay timelines assumed in current bids

- Oil markets remain riotous to geo-political shocks that could whip inflation in any direction

- Rising electric vehicle adoption rates might hasten highway funding declines long term

While the 3-year window looks optimistically robust, sufficient risks prevail to modulate over-exuberance. Scenario planning helps businesses strategize resilience by bracing operations for eventuality response. Still, appropriate short-term risks seem worthwhile given the visible mid-term tailwinds.

VII. The Road Ahead: Navigating Smart Investments

In closing, the extensive analysis makes evident the myriad factors enhancing asphalt ecosystem outlook over the next few years from recovering infrastructure commitments, urban development drives and sustainability policy action.

Yet road-builders remain at a crossroads. Scaling production risks growing emissions absent conscientious interventions. Materials intensity poses waste challenges exacerbated by designs lacking circular forethought. Auto-centric planning falls behind mobility innovations promising decongestion, connectivity, and accessibility.

As a result, our role expands beyond performing contracted tasks toward responsible advisors co-creating cities benefitting all citizens. By questioning objectives, collaborating across domains, and boldly leading markets toward spiritually sagacious outcomes, we manifest the change we wish to see on the horizons ahead.

- For contractors, astutely target specialist niches across promising metros combining demand momentum, green incentives, and technology leadership

- Municipal road agencies should require lifecycle cost analysis and restorative solutions in project tenders

- Construction firms stand to gain share by communicating sustainability commitments and distinctions

- Investors should evaluate portfolios for positive societal impacts aligned with financial returns

Collectively, we possess profound potential today to uplift infrastructure capabilities transforming human progress and ecological prosperity. That aspirational next chapter begins now.

Emerging Asphalt Innovations Through 2026

With sector growth projections positive in the medium term, what cutting-edge technologies, processes, and products will gain traction across the asphalt value chain? Let’s highlight key advancements upgrading capabilities year-over-year:

2024: Scaling Plastiphalt & Recycling Capacities

- Plastiphalt Trials Expand: More pilot tests deploy existing and advanced plastic polymers to enhance asphalt performance while providing end markets for non-recyclables

- Municipal RAP Adoption Accelerates: Landfill diversion mandates increase reclaimed asphalt pavement uptake to 25-50% in new pavement mixes across progressive states through legislation

- Next-Gen Roof Shingles Commercialize: After R&D, cooling roof designs leveraging near-infrared reflective coatings launch allowing 10-15% material savings versus traditional shingles

2025: Carbon-Minimizing Materials & Robotics

- Bio-Oil & Alternative Binder Use Rises: Improved yield projections for cooking oil, fatty acids, and forest derivatives boost bio-asphalt mix adoption targeting a 10%+ share in low-traffic roads

- Autonomous Truck Prevalence Grows: Advanced computer vision AI models pilot scaled autonomous haul truck fleets across large mining sites and highway projects lowering emissions

- Rejuvenator Commercial Viability: Nanotech rejuvenating agents extend aging municipal road lifespan at a lower cost than resurfacing, with over 15 US cities piloting 500+ lane miles

2026: Circularity & Grid Harmonization

- Grid-Balancing Production Design: New asphalt plants engineered to reshape load profiles by plugging excess renewable energy. Ontario pilots 25 MW flexible facility synchronizing output to system net load needs

- Mainstream Plastic & Rubber Recycling: Scaled commercial facilities come online to recycling incorporate over 15% end-of-life plastics and rubber into standard asphalt mixes

- Heat Recovery & Storage Streamlining: New metro area capacity adopts municipal waste heat and thermal storage to achieve 70%+ energy demand reductions during non-peak hour production

Thus continual waves of progress characterize the asphalt market outlook – from bitumen modifications and advanced surfacing today toward deep decarbonization and closed-loop circularity in the coming half decade.

Which of these technologies or material solutions excites you the most? Have I missed highlighting any key innovation frontier you find personally promising? Let me know your thoughts below!